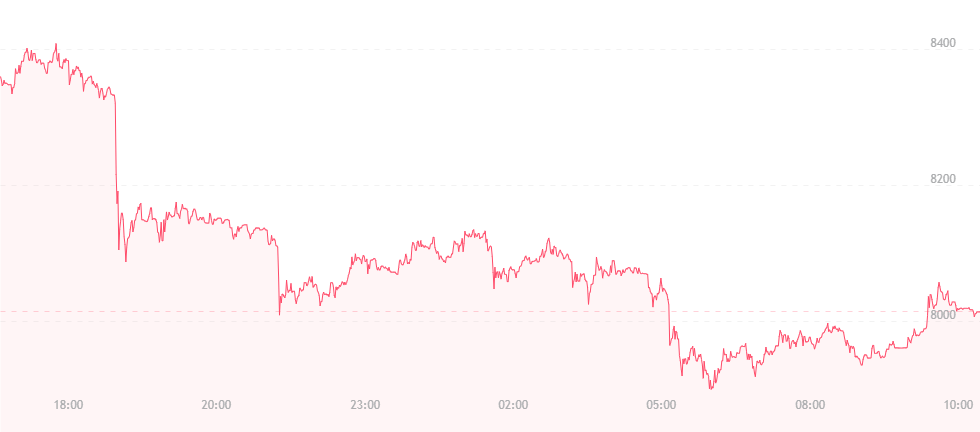

Bitcoin’s price has suffered a slight blunder. After spiking to nearly $8,400 over the weekend, the coin fell during today’s early morning hours to $7,900, but has since rebounded to about $8,000 at press time. It’s good news to know that while bitcoin failed to develop stronger resistance during its Sunday high, the drop wasn’t any worse.

Joining bitcoin with an exact-matching four percent drop in value is ether, which has fallen from approximately $537 to $503 at the time of writing. In addition, bitcoin cash, Ripple’s XRP and litecoin have all fallen by roughly three percent each.

Drops in the bitcoin price can largely be attributed to selling pressure. This can ultimately halt gains and give rise to temporary slumps, though most analysts believe the present fall is only in the short-term. Granted bitcoin can stay above $7,650, the worst days of bitcoin may be long gone, and recovery can occur almost immediately. A swift break above $8,100 could pave the way to $8,200, followed by another $300 rise to $8,500.

The next goal will be to break the $9,000 barrier, which experts claim isn’t too far off the mark given bitcoin stays above the mentioned price line.

Furthermore, several top financial figures remain bullish on bitcoin’s future. Dan Morehead, CEO of San Francisco’s Pantera Capital, believes that due to recent sell-offs, the price of bitcoin could spike beyond its $20,000 peak last December by the end of 2018.

“Today is a great day to get long,” Morehead wrote on Medium. “I rarely have such strong conviction on timing. A wall of institutional money will drive the markets much higher.”

News of upcoming bitcoin and cryptocurrency ventures amongst major players is also likely to assist the price in the long run. Barclays, for example, has announced that it will launch a cryptocurrency trading desk tailored for institutions and crypto hedge funds alike. Furthermore, Barclays signed Coinbase as a customer not too long ago, meaning the company has become the first British Bank to sign a major, U.S.-based digital currency exchange platform.

What is particularly interesting about this news is that Barclays’ researchers recently suffered from a case of the old gloom-and-doom when it came to bitcoin, claiming that the currency had reached its highest possible point last December and would never experience price hikes of that magnitude again. The release of its new trading desk and its partnership with Coinbase suggests that Barclays may be having second thoughts when it comes to the power of cryptocurrency – or at least that it recognizes enough present-day value to seek a temporary or short-term way inside.

In an interesting twist of fate, one expert is predicting big things for Ripple’s XRP over bitcoin. CEO of BKCM Brian Kelly explained in a recent interview that while bitcoin may be the primary cryptocurrency in today’s market, it is still in its “early days,” and thus vulnerable to mass volatility and related issues. He suggests that Ripple’s integration with banks and traditional financial institutions will ultimately help it to establish stronger legitimacy, and thus “convert” cryptocurrency “cynics” more than bitcoin ever could.