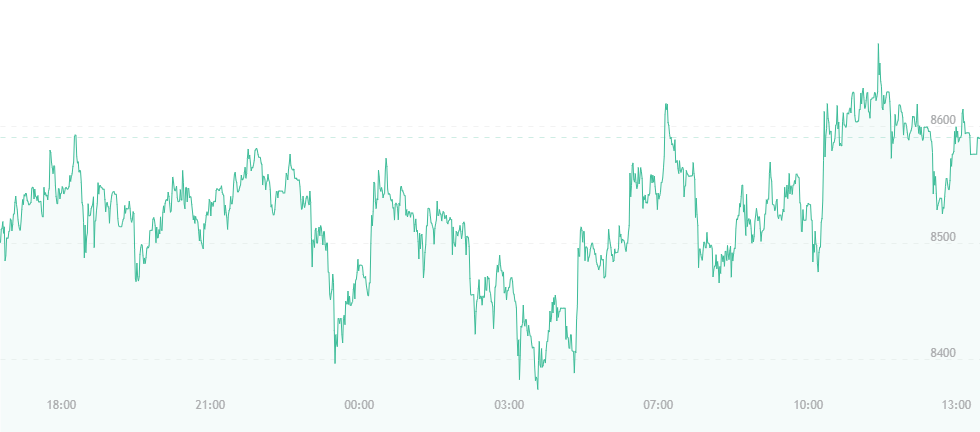

Bitcoin has endured another $300 slump. After trading at nearly $8,900 and giving many advocates hope that it could potentially reach $9,000 in the coming days, the father of cryptocurrencies has ultimately shrunk back.

Overall, both bitcoin and ether fell nearly four percent from yesterday’s “highs” following what appeared to be a steady week of small, yet noticeable growth. Analysts widely claim that the jump may have been a result of bitcoin striving to spike above fear surrounding Binance, the Hong Kong-based cryptocurrency exchange also operating in Japan.

“Land of the rising sun” regulators had given Binance a warning memo explaining that the company was operating without proper registration, and that if it didn’t play be the rules, it would face reprimands. Binance CEO Changpeng Zhao later released a statement, commenting that the warning was nothing big and that investor shouldn’t worry:

“We received a simply letter from JSFA about an hour ago. Our lawyers called JFSA immediately, and will find a solution. Protecting user interests is our top priority. No need to worry. Some negative news often turns out to be positive in the long term. The Chinese have a proverb for this. New (often better) opportunities always emerge during times of change.”

But while Binance continues to work out its problems, bitcoin cannot seem to decide where it wants to be. This $300 slump is nothing new; in fact, our previous price watch pieces seem to be inciting a theme. Bitcoin rises $300, then falls by the same amount. This is likely the window where the digital asset, for whatever reason, is encountering the most resistance, and it’s proving a hard barrier to break.

Interestingly, however, it appears many experts are still bullish on bitcoin’s price, saying it could strike the $30,000 mark by early December.

This prediction comes primarily from David Drake – founder and chairman of investment firm LDJ Capital – who explained to regulators at the recent G20 summit that bitcoin had been encountering a “cold winter,” but that things were likely to strike new ground by the end of the year.

Where Drake does differ is in his stance on digital currencies in the future, primarily on how many will exist. Previously, Twitter and Square CEO Jack Dorsey explained that he felt bitcoin could become a “single” currency in the end – that all other forms of fiat and digital assets would ultimately disappear, leaving bitcoin as the only usable option to pay for goods and services.

While he agrees that bitcoin is the primary form of digital currency today, Drake doesn’t seem to think it will stand alone. Right now, he says there are approximately 1,500 different cryptocurrencies on the market. He admits that some are “strange” or fraudulent in some way, but comments that those which have stood their ground (i.e. ether, litecoin, etc.) could make their way up the financial ladder along with bitcoin, and that years from now, while money may all be digital, the industry will not rely strictly on bitcoin alone.

It is probably just a matter of sitting back and waiting to see what occurs.