Today marks exactly one year since the Hyperliquid genesis event and the launch of its native token $HYPE on November 29, 2024.

The project is celebrating its first anniversary just as its long-awaited weekly unlocks officially begin, a moment the community has been anticipating for months.

This anniversary isn’t just symbolic. It marks the start of a new distribution era, one that will test the ecosystem’s maturity while adding clarity to how the Hyperliquid team manages supply, incentives, and trust.

The first unlock is already live. And the numbers give a clear picture of how Hyperliquid intends to move forward.

Happy 1 Year Anniversary @HyperliquidX

Today marks exactly one year since the Hyperliquid genesis event and the launch of its native token $HYPE on November 29, 2024. That day kicked off with a massive community airdrop distributing 310 million tokens to nearly 94,000 early… pic.twitter.com/BK9RrL0zdC

— MB (@MBxxvv) November 29, 2025

A Look Back at Genesis: The Day Hyperliquid Broke the Mold

The Hyperliquid genesis event made waves across the entire crypto landscape last year.

It launched with a massive airdrop of 310 million $HYPE tokens to almost 94,000 early users, immediately setting the tone for a different kind of ecosystem.

- No private rounds.

- No VC allocations.

- No institutional lockups shaping the early supply.

Instead, Hyperliquid chose a VC-free launch, a bold stance that placed ownership directly in the hands of traders, market makers, and early builders. At a time when most new chains and protocols were leaning heavily on venture money, Hyperliquid went in the opposite direction, and the market took notice.

That ethos made the project one of the standout stories of late 2024.

And now, one year later, the first major supply unlock since staking began is finally here.

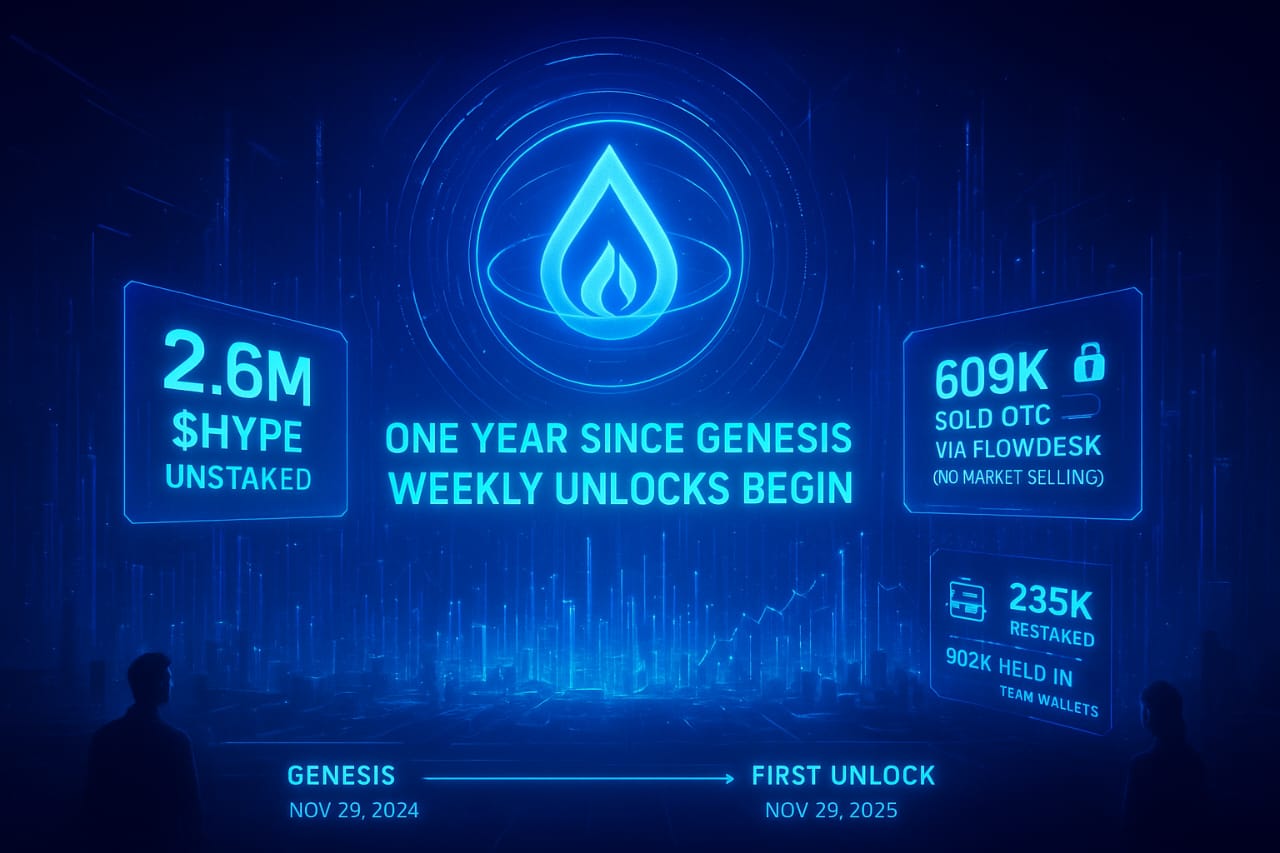

Weekly Unlocks Begin: 2.6 Million $HYPE Unstaked

After months of anticipation, Hyperliquid’s Weekly Unlocks officially started today.

The first batch: 2.6 million $HYPE tokens unstaked.

But what happened next is what caught the community’s attention.

Hyperliquid did not simply dump these tokens into the market. Instead, the movements were precise, controlled, and, for many holders, surprisingly bullish.

Update about the unlocks from Hyperliquid:

2.6M unstaked

854k restaked by Hyperlabs team

1.745M distributed to team walletsFrom these team wallets the following is done:

* 609k sold OTC (through Flowdesk)

* 235k is staked again by team members

* 902k is still in spot on… pic.twitter.com/lr4LQhaklx— Hyperliquid Eco (@HyperliquidEco) November 29, 2025

Breakdown of the First Unlock:

- 2.6M $HYPE unstaked in total

- 854k $HYPE immediately restaked by the Hyperlabs team

- 1.745M $HYPE distributed to team wallets

This distribution triggered deeper tracking of how these tokens were managed once they arrived in team-controlled wallets. And the follow-through tells its own story.

Where Did the Tokens Go? A Transparent, Trackable Breakdown

From the 1.745 million tokens sent to team wallets, the internal allocation followed three clear paths:

1. 609k $HYPE Sold OTC

These tokens were sold over-the-counter through Flowdesk.

This is the key detail that has many community members feeling more optimistic than expected. The sale did not go through open market sell pressure. No slippage. No spot-market impact. No sudden price walls.

OTC is typically used by teams that want:

- controlled liquidity distribution,

- reduced volatility,

- and long-term holders rather than short-term traders.

2. 235k $HYPE Restaked

Team members voluntarily restaked a meaningful share of their tokens.

This signals:

- internal confidence,

- long-term alignment,

- and commitment to maintaining validator security.

3. 902k $HYPE Remaining in Spot on Hypercore

This portion is currently untouched.

- No sells.

- No staking movements.

- No transfers.

It sits idle, likely awaiting either future internal allocations or transparent movement updates.

Community Reaction: Controlled Unlocks Seen as a Positive Signal

The response from traders and long-time HYPE holders has been cautiously optimistic, even bullish.

The key reason: the team chose OTC sales instead of market sells.

That single decision prevented sudden price swings and reduced the risk of cascading volatility. For a token that prides itself on fair launch principles, this approach reinforces the culture of sustainability over short-term extraction.

A researcher tracking the wallets publicly wrote:

“Seems quite bullish to me. The team is only selling OTC, not on the market. Will keep tracking what they are doing.”

Transparency and clean on-chain behavior matter, especially in ecosystems built around high-frequency traders and large liquidity flows. Hyperliquid’s consistency in showing its work strengthens that trust.

Why This Unlock Matters: A New Phase for Hyperliquid

The first anniversary also marks the official beginning of Hyperliquid’s next phase.

The market is watching closely for several reasons:

1. Supply Dynamics Are Changing

For the first time, meaningful unlocks introduce new liquid tokens into circulation. How these are handled will shape price behavior, market depth, and staking incentives.

2. The Team’s Behavior Sets the Tone

If the team continues using OTC channels and restaking their allocations, it may reduce volatility and reinforce long-term alignment.

3. Growth Expectations Are Rising

Hyperliquid is no longer a new experiment.

It is now:

- a year old,

- deeply integrated across on-chain trading,

- and supported by one of the most active derivatives ecosystems in crypto.

The market wants to see how weekly unlocks affect metrics like:

- open interest,

- daily volume,

- staker participation,

- and governance flows.

So far, week one has delivered a cleaner outcome than many expected.

A Full Year Later: Hyperliquid’s Identity Remains Intact

One year after its VC-free genesis, Hyperliquid is still operating with the same principles it started with:

- transparency,

- community ownership,

- and open market behavior that doesn’t blindside holders.

The launch of weekly unlocks could have introduced chaos.

Instead, it has shown a methodical, predictable approach that maintains confidence and supports long-term sustainability.

Hyperliquid enters year two with:

- a growing user base,

- a maturing token economy,

- and a clear structure for unlocks and supply movements.

The ecosystem now faces its next test: converting this careful management into continued growth and product expansion.

For now, the first unlock has landed cleanly.

And the market is watching what Hyperliquid does next.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services.

Follow us on Twitter @themerklehash to stay updated with the latest Crypto, NFT, AI, Cybersecurity, and Metaverse news!