There are several widespread lending and borrowing projects in the crypto ecosystem. This article will highlight 4 of them. These platforms help users borrow cryptocurrencies and earn interest while leveraging crypto assets to generate revenue. You can also invest in these projects using your cryptocurrency.

While regulators are still trying to figure out whether to approve Bitcoin spot ETFs, the nature of cryptocurrency enables the progression of DeFi technology into the P2P borrowing & lending protocols listed below.

Cryptocurrency borrowing and lending protocols are part of the DeFi category of crypto projects. Utilizing blockchain technology, the projects listed below provide competitive borrowing and lending peer-to-peer rates which would be impossible to facilitate without the underlying decentralized technology.

Note: The list below is ordered by the market capitalization of each lending and borrowing platform, lowest to highest.

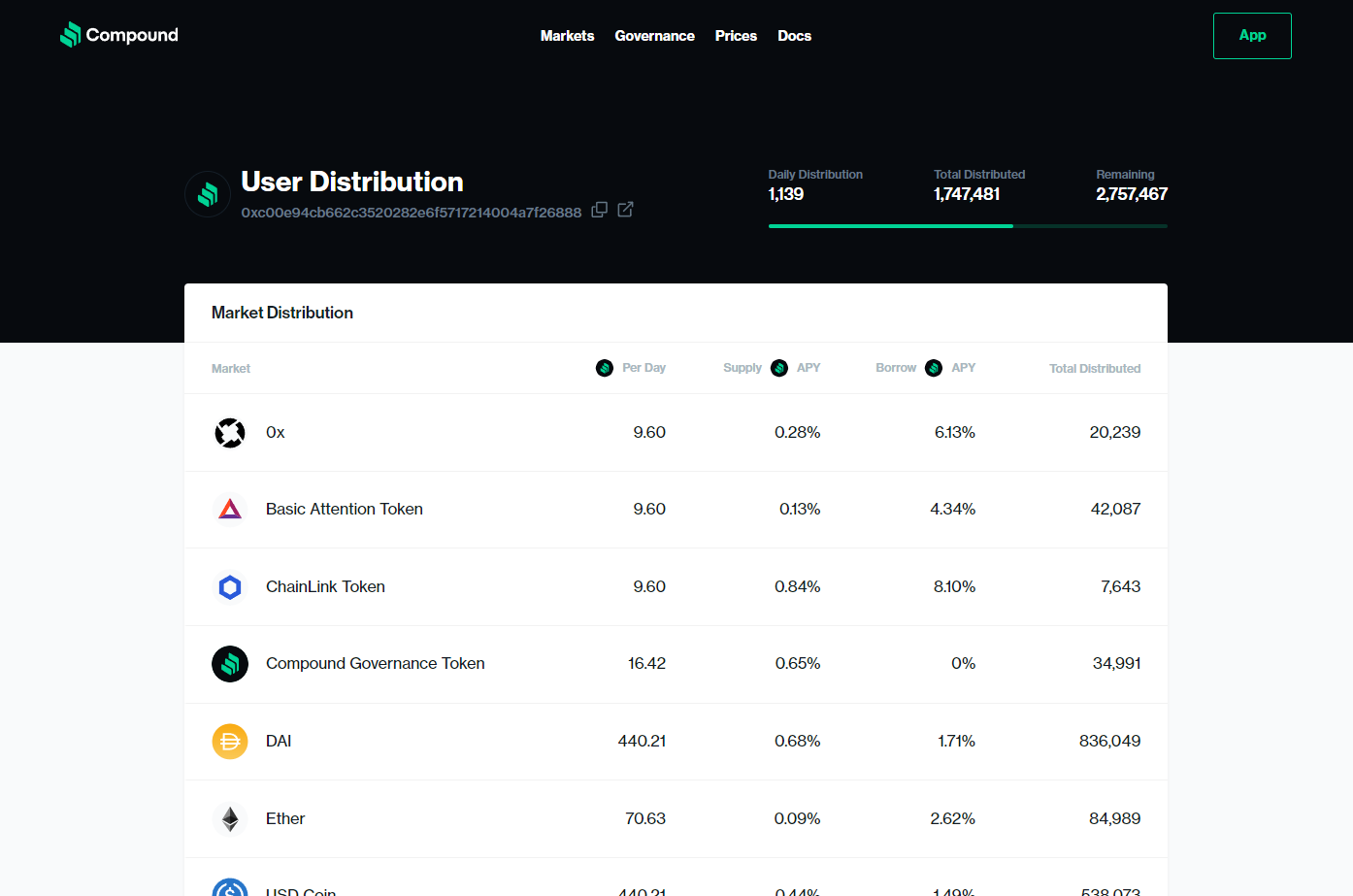

4. Compound (COMP)

- Market Capitalization: $351 million

- Unit Price: $49.08

Launching its mainnet in September 2018, Compound (COMP) is a decentralized marketplace that allows users to borrow or lend cryptocurrencies. It runs on the Ethereum blockchain and trades eth-compatible assets. Robert Leshner, the developer of the project, announced that the project would move to a different blockchain called Gateway and serve as a platform for cross-chain interest rate markets. While the Compound project is not yet wholly decentralized, it offers many advantages for its users who want to use cryptocurrencies to borrow money.

Users can deposit their cryptocurrencies and borrow from others using the Compound protocol. The users are required to pay a fee known as “gas” to use the platform. The fee is paid in COMP tokens and is settled using their preferred wallet. Once a user has lent or borrowed cryptocurrency, they can claim these tokens by placing collateral on their accounts. This means that they can receive profits without investing a significant amount of money.

3. Kava (KAVA)

- Market Capitalization: $418 million

- Unit Price: $1.88

Launched in October 2019, the decentralized lending and borrowing project Kava uses Cosmos SDK and operates on a Proof-of-Stake consensus mechanism. The project enables people to borrow and lend crypto assets, creating a lending platform that allows users to borrow and lend any type of cryptocurrency. The project offers both loans and stablecoins and even an interest-bearing account. It’s also compatible with coins such as XRP, ETH, Litecoin, and Tether.

The lending platform went live in August 2020 and had been rapidly growing in popularity. In its first year, users could use BNB as collateral for crypto loans in USDX. Over $24 million USDX and $8 million BNB have been loaned using Kava to date. Those who borrow or lend KAVA can expect to receive interest equal to the current USDX savings rate.

2. Maker (MKR)

- Market Capitalization: $975 million

- Unit Price: $997.90

Launched in January 2017, the Maker system allows users to borrow Dai against the value of their crypto tokens. To borrow Dai, the user must deposit at least 150% of the loan’s value into the Maker vault. Borrowing Dai involves a stability fee, which varies from time to time. The stability fee is used to buy MKR from the open market or burn it.

In addition to offering this function, Maker lets users vote on the platform’s management. By allowing users to vote, the platform can better govern itself and increase its price. As a result, Maker is one of the largest stablecoins by market cap. In addition, it promotes using its stablecoin, Dai, in games, prediction markets, and cross-border transactions. Maker is one of the few projects in the crypto ecosystem that provides both real-world utility and a promise of continued growth. To learn more, visit our FAQ page.

1. Aave (AAVE)

- Market Capitalization: $1.041 billion

- Unit Price: $74.84

Launched in October 2020, the Aave protocol is a decentralized lending and borrowing platform. This means that users can invest in liquidity pools, which they can use to offer loans to other users. These liquidity providers will earn interest from the loans they issue and vice versa. Aave allows users to provide loans for different values, and the lending pool can accommodate varying markets.

Aave’s decentralized lending and borrowing platform have been gaining traction in the crypto ecosystem, primarily due to its decentralized nature. The project allows users to lend and borrow cryptocurrencies without facing any middlemen. This lends the platform greater transparency than traditional lending services, which operate in a closed-door manner. It allows users to track and inspect lending processes, and third-party auditors ensure the quality of the loan.

The above article has been created as a result of the detailed analysis of the projects’ websites.

Follow us on Twitter @themerklehash to stay updated with the latest Crypto, NFT, AI, Cybersecurity, and Metaverse news!

Image Source: sirinapa/123RF