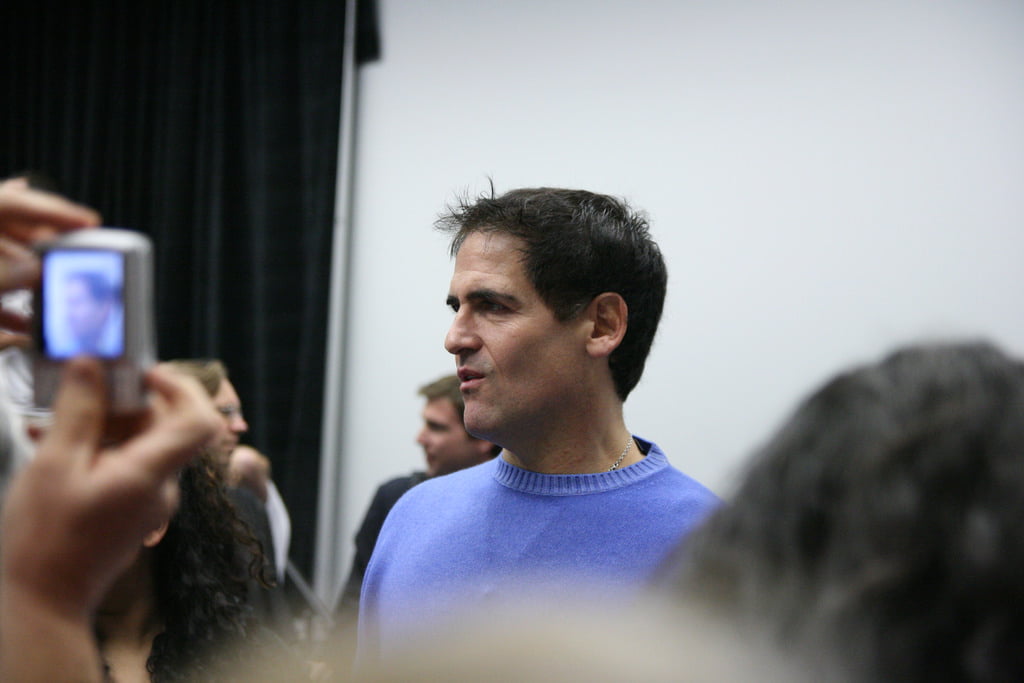

In an interview with Bloomberg’s Emily Chang at the Vanity Fair New Establishment Summit in Los Angeles, billionaire investor and Dallas Mavericks owner Mark Cuban reaffirmed his investment in bitcoin.

For many months, Cuban had hinted at plans to invest in bitcoin and other cryptocurrencies. On October 3, Cuban confirmed that he had purchased bitcoin through the Swedish bitcoin exchange-traded fund (ETN) XBT Provider, which is traded on Nasdaq Nordic.

XBT Provider is the same bitcoin ETN provider which JPMorgan clients used to invest in bitcoin. In September, it was revealed by bitcoin developer Andrew DeSantis and prominent bitcoin trader IamNomad that custodian accounts of JPMorgan Securities Ltd had processed various transactions to the accounts of XBT Provider, processing investments into the Swedish bitcoin ETN.

There is No Such Thing as Intrinsic Value

During the interview, Cuban emphasized that the baseless condemnation of bitcoin from key figures in the financial sector including JPMorgan Chase CEO Jamie Dimon is inaccurate because the concept of intrinsic value in assets and stocks is fundamentally flawed. Value is subjective and the price of assets and stocks depends on supply and demand. The value of fiat currencies can be manipulated and altered, and hence do not have intrinsic value.

Cuban explained:

“It is interesting because there are a lot of assets which their value is just based on supply and demand. Most stocks, there is no intrinsic value because you have no true ownership rights and no voting rights. You just have the ability to buy and sell those stocks. Bitcoin is the same thing. Its value is based on supply and demand. I have bought some through an ETN based on a Swedish exchange.”

At a banking conference hosted by Barclays which Dimon attended, highly regarded venture capitalist and Golden State Warriors owner Chamath Palihapitiya offered a similar criticism toward Dimon as Cuban, noting that the value of bitcoin depends on the market and that the government has limited power in restricting and regulating bitcoin.

“[Bitcoin is] absolutely not [a fraud]. It cannot be a fraud. What countries can constrain today is how it [bitcoin] is effectively traded but it cannot be controlled. It is a fundamentally distributed system that exists peer to peer. And so to the extent that you can basically eliminate the will and the actions of every single person in the world, you can eliminate it. But in the absence of that, the genie is fundamentally out of the bottle,” said Palihapitiya.

As bitcoin continues to evolve as a technology, digital currency, and a store of value, high profile, institutional, and retail investors will adopt bitcoin and demonstrate increasing interest toward the cryptocurrency market. General consumers and users of existing banking systems are beginning to recognize the benefits of bitcoin as a decentralized financial network and peer-to-peer protocol that eliminates the necessity of intermediaries and mediators.

Image License: Marc Levin, For Commercial Use